Advances in Syngas Production: Catalyst and Process Developments Update – 2018

STUDY COMPLETED!

New TCGR Study Documents Advances in Syngas Production Achieved via Catalyst, Reactor and Process Engineering Gains…

View presentation here (PDF format)

“ADVANCES IN SYNGAS PRODUCTION: CATALYST AND PROCESS DEVELOPMENTS UPDATE – 2018”

This TCGR multi-client study was launched in late-July and completed in November 2018. The study’s scope, and actual Table of Contents (as depicted in the TofC on pages 10-20 of the presentation, available via download above), reflect the inputs from a group of “charter” subscribers who have indicated their priorities for coverage, areas to be expanded/deepened and focal points for emphasis in opportunity identification. These are leading developers of technology for syngas production as well as the large volume syngas producers and users.

TCGR provided its last update on syngas production advances in 2014, with a two-volume set of multi-client studies entitled “Natural Gas Conversion vs. Syngas Routes: A Future of Convergence-2014”. The purpose of this 2018 update, four years since our last, is to focus more narrowly on syngas production and benchmark the numerous advances in catalysts, reactor internals, and life cycle advances — not only those that have been recently commercialized, but also those in the pipeline. Keeping abreast of these improving productivity and yield changes, which may be incorporated into turnaround schedules, is a vital part of maintaining manufacturing competitiveness.

TCGR’s new assessment has (as always) allowed “charter” subscribers to help shape this update’s Table of Contents (i.e., content about which technologies are to be included), thereby creating a multi-company sponsored effort in a process we call – by the industry, for the industry! To highlight some of the revised/expanded thinking about what is included, without any particular order, we list the following:

- New dry reforming technology to be licensed from BASF/Linde (per Figure 1 below):

- New syngas reactor technology being introduced from Haldor Topsoe (H-T) – SynCor – to eventually

produce ammonia or methanol - The potential use of a new rotary reactor in pilot, being pursued and supported by Dow Chemical

- Further developments with membrane reforming (e.g., Praxair, CoorsTek)

- Johnson Matthey’s (J-M’s) introduction and expansion Catacel SSR, metal substrates

- Zoneflow engineered packing

- New reactors and heat integration (e.g., J-M HER; H-T HTCR, HTER, TBR, etc.)

- Other material development (e.g., tube materials, dusting, etc.)

- Hybrid solutions (e.g., green syngas) and waste/waste plastics to syngas

- Advances in AGHR (J-M) and KRES (KBR)

- Advances in Chemical Looping Reforming/CLR and CPO

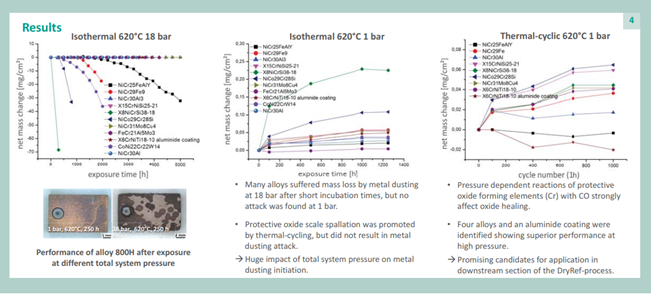

Figure 1. Dry Reforming Test Results

As an indication of the report’s findings, we highlight the following:

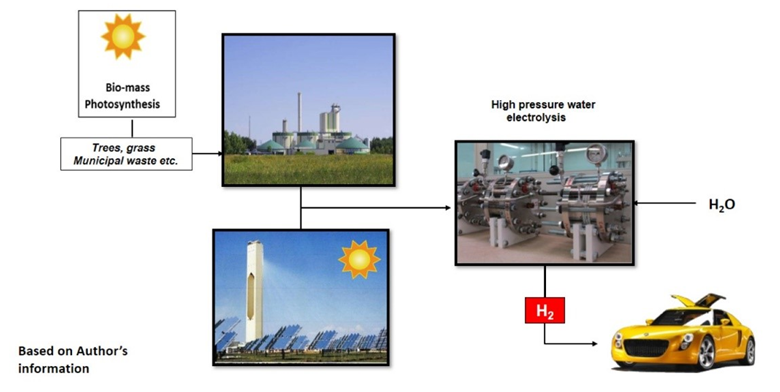

- The major shift during the last four (4) years has been the industrial, government and academic investment with advancement into “GREEN HYDROGEN” (see Figure 2). This is the production of hydrogen through water electrolysis but using newer proton exchange membrane (PEM) technologies, as opposed to historical alkaline technologies, which is typified by the EU H2FUTURE PROGRAM. Funded pilots are happening globally, e.g. ITM Power with initial plants at the 6MW level, but plans are in place to scale to 100MW by 2022. These are not only being sponsored in Shell’s REFHYNE in their Rhineland refinery to replace SMR but also for numerous Evonik/ThyssenKrupp projects in the steel industries. Moreover, “green hydrogen” is just the beginning of the “POWER TO X” value chain, where it is hoped that the longer term vision is the production of biofuel, biochemicals and the like not derived from crude oil.

Figure 2. Future hydrogen production scheme

Figure 2. Future hydrogen production scheme

- The application probably not receiving enough attention is actually the fuel cell automobile market, where an additional driver is the production of “green hydrogen” and H2 refueling distributed stations for different developing markets in Scandinavia, Germany and the U.S. H2FUTURE has committed to both that infrastructure, as well as 1,000 vehicles on the road by 2022. Interestingly, CARB in the U.S. already has 5,000 vehicles on the road, with 45,000 projected over the same time period.

- While reforming (SMR, ATR) remains the lowest cost method to produce H2 at scale, it is to be challenged over the next five to ten tears by PEM technology, which hopes to reduce its costs by 33%-55% over the next five years as it is scaled-up to higher capacities. The debate is still out on that prediction (see Figure 3).

Figure 3. Scale Dependence of Unit Cost (Source: Renewable Hydrogen

Roadmap, Jeffrey Reed, PhD/University of California – Irvine, 2018)

Assembling such as assessment, is extremely valuable to the commercial, as well as R&D/technical, processes of companies looking to decide their own research programs or in looking into venture capital investments. Thus, TCGR’s report becomes a valuable resource in the senior management decision-making process. As usual TCGR’s insight into pipeline technology and developments provides a tool that is not available from other sources, which are more focused on market supply/demand or benchmarking just the top three (3) licensed processes in manufacturing technologies.

* * * * *

As it does in each of its industrially-focused multi-client studies, TCGR has sought input from “charter” subscribers (i.e., those who signed-up

prior to study launch) to help shape the report’s final scope/TofC by delineating areas of particular interest, as depicted in the actual TofC.

* * * * *

Additional information, including the updated study presentation, the actual Table of Contents and the Order Form, can be downloaded via the link below.

For additional study details or to subscribe, please contact John J. Murphy at +1.215.628.4447 or John.J.Murphy@catalystgrp.com.

The Catalyst Group Resources (TCGR), a member of The Catalyst Group, is dedicated to monitoring and analyzing technical and commercial developments in catalysis as they apply to the global refining, petrochemical, fine/specialty chemical, pharmaceutical, polymer/elastomer and environmental industries.