Technology and Business Integration

Technology and Business Integration: Optimizing Intellectual Property for Growth

Many Fortune 500 energy and chemical companies operate extensive R&D programs supporting their core businesses. Additionally, mergers and acquisitions include intellectual property (IP) ownership, further expanding these portfolios.

Result: These organizations own and manage significant patent portfolios.

Catalytic and process technologies are constantly evolving. New developments render existing technologies less competitive in the marketplace. Likewise, companies are reorganizing to focus on core strengths, leaving patents misaligned with future strategies.

Finding Value in Intellectual Property

IP holds value. However, identifying and maximizing its worth requires a strategic approach. The question often arises: is buying or selling a patent portfolio a sound investment? The answer lies in a systematic evaluation process balancing technical, competitive and business considerations.

Key factors include:

Assessing underutilized assets: Determining patents aligned with long-term goals.

Unlocking hidden value: Identifying opportunities for monetization, licensing or partnerships.

A Client-Centric, Interactive Consulting Approach

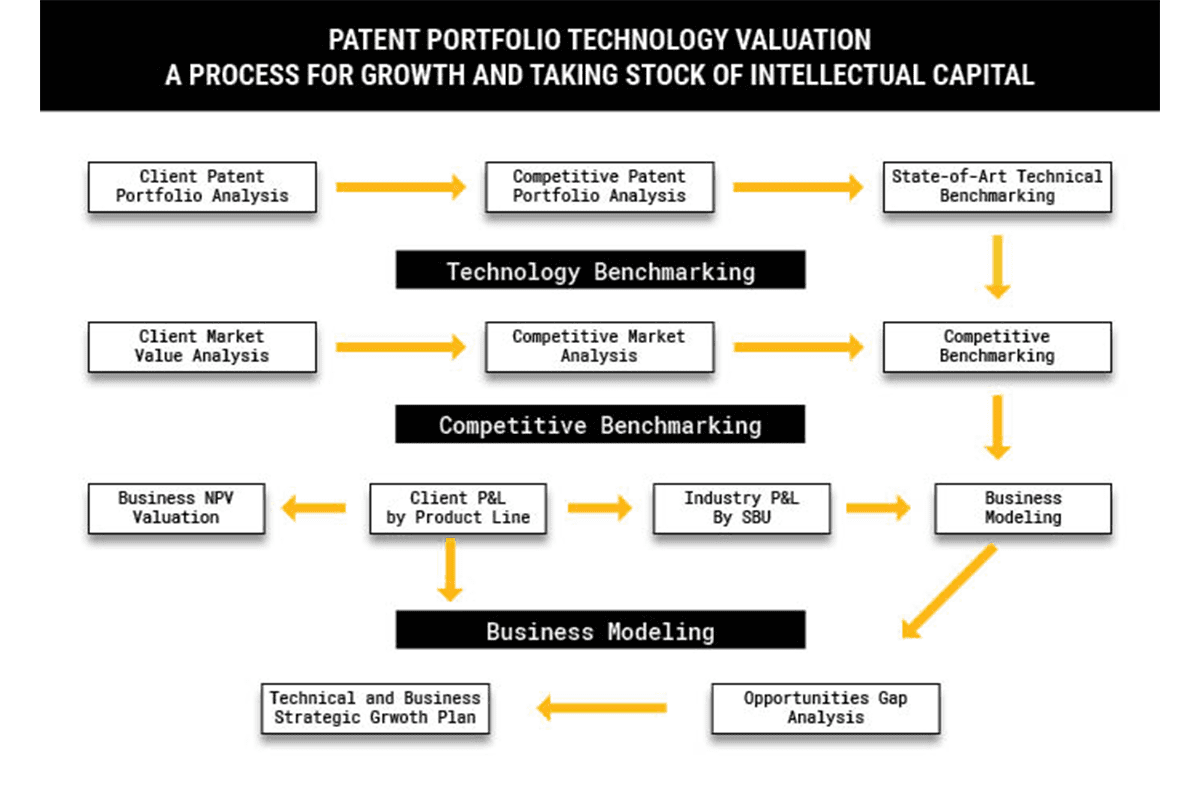

The Catalyst Group (TCG) offers a structured framework called Patent Portfolio Technology Valuation (PPTV). This process analyzes and optimizes IP portfolios through technology benchmarking, competitive analysis and business modeling. This methodology unlocks IP portfolio values using detailed evaluation, modeling and strategic alignment with market and commercial needs.

The PPTV process is structured into distinct stages:

Outcome: Strategic Growth Planning

Results provide a sound technical and business growth plan, including gap analysis.

Proven Success

TCG’s PPTV process enables clients to generate growth opportunities, reduce costs associated with non-essential IP and support long-term innovation strategies.

By integrating IP assets more effectively, companies can control resources and explore new revenue options. For example, donating IP to universities or research institutions provides organizations with both financial and reputational benefits, including tax credits.

Case Examples:

Strategic IP Management

By leveraging PPTV, energy and chemical companies transform their IP into strategic assets supporting long-term success.

Unlock the Full Potential of Your IP and Technology Assets

TCG is more than a consulting group—we’re partners. We assist companies in exploring IP portfolios that yield long-term growth.