R&D organizations have traditionally been responsible for invention, discovery and developing intellectual assets (e.g., patents) that have brought companies real growth and value, supporting the new product pipeline for years to come. Today, chemical companies understand that real growth is no longer dependent on R&D investment or reengineering R&D processes. Rather, companies know they must now better manage the intellectual property that R&D generates — especially patents.

Yet, how many division or business unit managers can give you an answer to “what if” questions “within seconds” by running your query through their own proprietary computer business model-online? Not many!

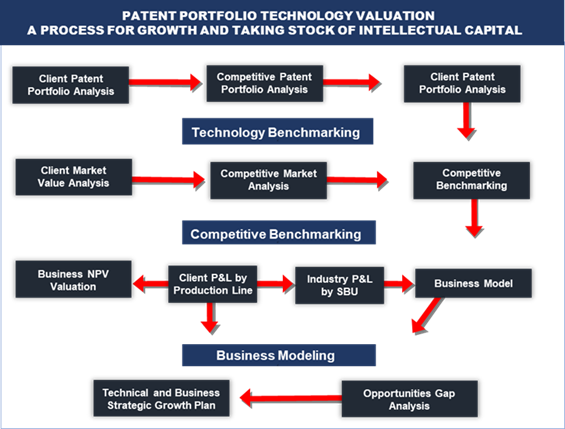

To address this need, The Catalyst Group Consulting (TCGC) has developed a formal process, called Patent Portfolio Technology Valuation (PPTV), which has been used successfully by several clients. With renewed acceleration in the rate of new patent development expected, the PPTV approach promises that patent estates can be managed to bring about highest value, by ensuring that all SBUs have knowledge and access to valuable patents for product development and licensing. The approach also provides a process for culling patents that add no value to their overall portfolio.

As can be seen in the Figure, the modules allow for both technology benchmarking against near competition, market benchmarking of product sales, as well as business unit modeling to understand P&L by SBU, leading to business NPV or opportunities gap analysis allowing for business restructure questions. This allows clients to link intellectual assets to the business net present value (NPV). The business modeling function in the PPTV process can also be a powerful tool for growth management at the SBU level. By adding an “opportunities gap analysis” to the completed model, you can determine the strength/weakness of the business from both technical and market perspective and reengineer the SBU for growth by transferring in the new technologies, changing product mix with emphasis, or dropping under-performing assets.

For more information, contact Clyde F. Payn, CEO, TCGC at cpayn@catalystgrp.com or by calling +1-215-628-4447.